Condo Insurance in and around Lomita

Here's why you need condo unitowners insurance

Cover your home, wisely

Would you like to create a personalized condo quote?

Welcome Home, Condo Owners

Are you investing in condo ownership for the first time? Or have you been a condo owner before? Either way, it can be a good idea to get coverage for your condo with State Farm's Condo Unitowners Insurance.

Here's why you need condo unitowners insurance

Cover your home, wisely

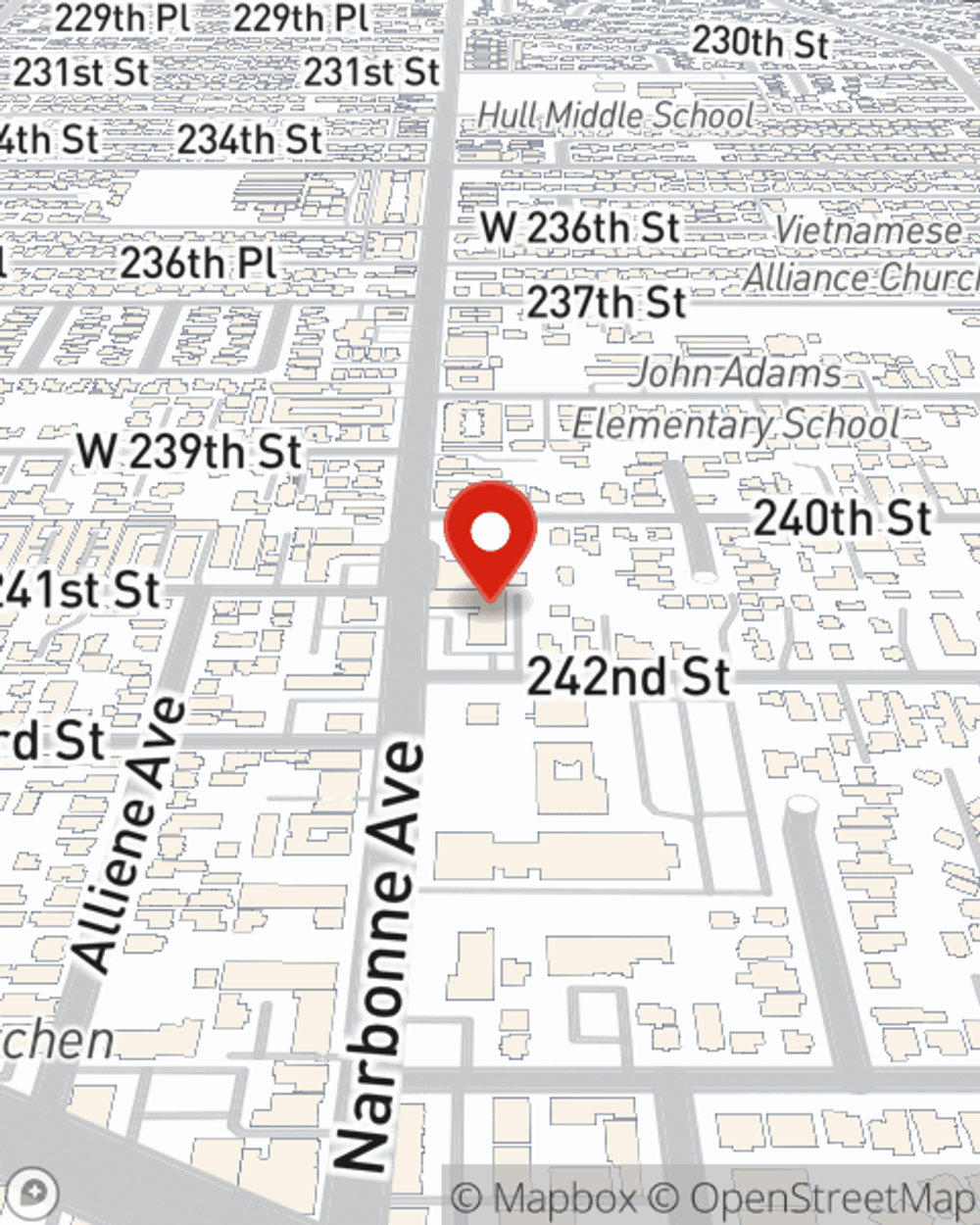

Why Condo Owners In Lomita Choose State Farm

Things do happen. Whether damage from weight of snow, vandalism, or other causes, State Farm has wonderful options to help you protect your condo and personal property inside against unanticipated circumstances. Agent Faby Obispo would love to help you set you up with a plan that is personalized to your needs.

Getting started on an insurance policy for your condo is just a quote away. Call or email State Farm agent Faby Obispo's office to explore your options.

Have More Questions About Condo Unitowners Insurance?

Call Faby at (310) 326-0075 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.

Faby Obispo

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Community and urban gardening

Community and urban gardening

Community and urban gardens are an excellent place for growing fresh food. Learn how to secure your garden plot and how to make the most of your space.